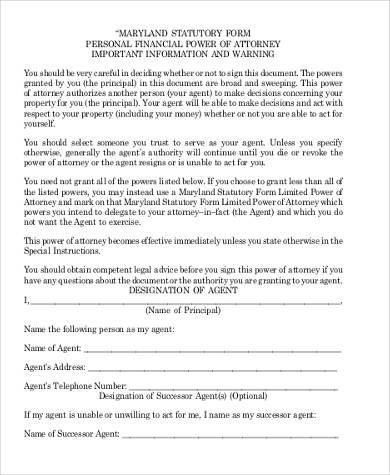

We will review the POA to confirm it is valid and review the instructions provided by the attorney under your POA.

#Ca financial power of attorney professional

We may require you to provide us with an original or notarized copy of the POA (if it has been prepared by a legal professional or otherwise) or the TD POA form, if you use one of our forms.If there is more than one attorney named in your POA, the POA should say whether the attorneys must act together (jointly) or if they can act separately (severally).You can appoint more than one attorney in the same POA and you may appoint a substitute attorney who will become your attorney if the original appointed attorney is not able to act for reasons like their own death or their own mental incapacity.You can cancel a POA at any time, so long as you have the mental capacity to do so, and you follow the applicable provincial or territorial laws that apply to cancelling a POA.You can continue to make decisions about your finances even when you have a POA in place, as long as you have the mental capacity to do so.

The attorney must act in your best interests to make decisions about your financial matters.

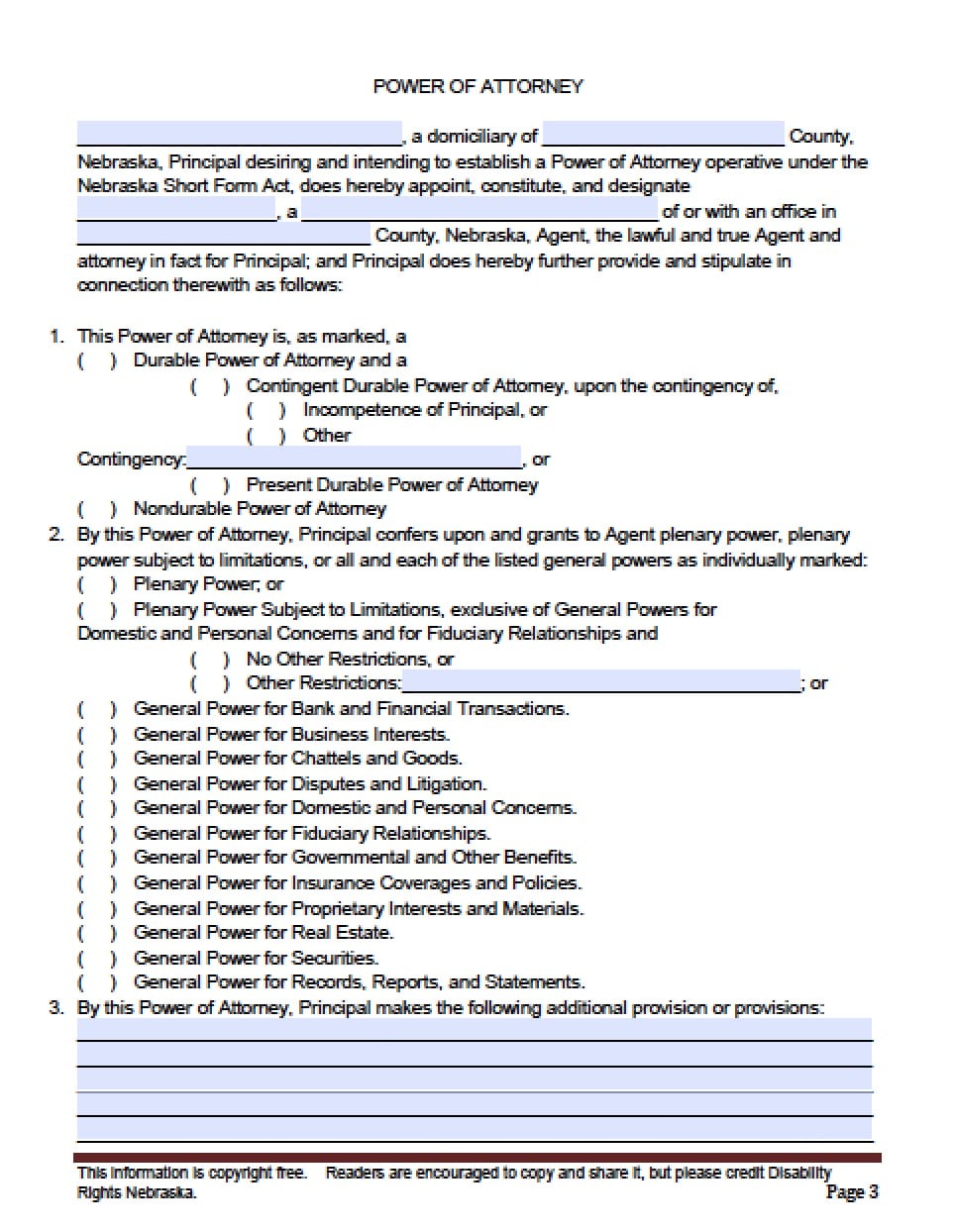

Your attorney does not need to be a lawyer, but should be someone you trust. A POA can apply for a specific or unlimited period of time, and depending on what the POA says, it can also cover the period after you become incapable of managing your own financial affairs. A POA is a legal document that you sign to give another person the authority (legal ability) to make decisions about some, or all of your financial affairs, which may include accounts you have with us. Proudly serving clients throughout Orange County, Financial Relief Law Center, APC offers legal assistance in both English and Spanish. We can draft the specific power of attorney based on your unique needs. This is especially helpful in terminal and nonterminal cases, such as disclosure of medical records.Ĭonsequences of not having a durable power of attorney include having to petition a court to appoint a guardian of the estate to make property decisions for a person who is incapacitated or disabled. Like a financial power of attorney, a durable power of attorney for property appoints an agent to make certain decisions concerning property and financial management.Ī health care power of attorney allows an agent to make health care decisions on behalf of a principal who is unable to make those decisions for him or herself. Like probate, these proceedings can be costly, protracted and embarrassing for those involved. Typically, this power of attorney can be used for property or health care. A durable power of attorney, however, survives death or incapacity. Durable Power of Attorneyĭurable powers of attorney, like other powers of attorney, are a written agreement whereby a principal designates an agent to act on his or her behalf. Generally handling financial matters on your behalfĪ financial power of attorney can make sure you do not fall behind on important financial matters in the unfortunate circumstances that you are unable to make these important decisions for yourself. Collecting insurance or government benefits. With a financial POA, your agent is allowed to take care of your finances when you are unable to, including: There are different types of power of attorneys, one of the most common of which is a financial power of attorney. Limited Power of AttorneyĪ limited power of attorney is a power of attorney that is narrowed for a specific purpose such as buying a home. A general power of attorney may be revoked by the principal by giving notice.

The principal gives the agent the power to do anything that the principal could do. It is the broadest power a person can give another person.

A general power of attorney is a legal document that gives an agent (delegated person) authority to act on behalf of a principal (the maker of the document).

0 kommentar(er)

0 kommentar(er)